In Ireland, the Euro and Pound Sterling are the two operative currencies, specific to the Republic of Ireland and Northern Ireland, respectively. This article covers everything you need to know about the Irish currency and provides actionable tips for a seamless financial experience while traveling.

Key Takeaways

Ireland uses two different currencies: the Euro (EUR) in the Republic of Ireland due to its EU membership, and the Pound Sterling (GBP) in Northern Ireland, part of the United Kingdom.

Currency conversion can be optimized by exchanging money before traveling, using cards to access favorable rates at ATMs, and being aware of fees for cash advances and foreign transactions.

Credit and debit cards (especially Visa and Mastercard) are widely accepted in Ireland, but it’s important to notify your bank of travel plans and understand potential fees, while cash is valuable in rural or smaller establishments.

The Two Currencies of Ireland

Ireland’s currency landscape is as diverse as its verdant hills and bustling cities. The country operates with two different currencies, each with its own distinct realm of acceptance. In the Republic of Ireland, the Euro reigns supreme, a legacy of its membership in the European Union. Venture north to Northern Ireland, and you’ll be dealing with the Pound Sterling, a nod to the region’s political ties with the United Kingdom.

That said, the lines blur a bit in the border regions. Here, businesses may accept both the Euro and Pound Sterling, a convenience for locals and travelers alike. Keep in mind, however, that not all businesses universally accept both currencies, and commonly accepted practices can vary from place to place.

Republic of Ireland: The Euro

In the Republic of Ireland, the Euro serves as their own currency, with the official currency code EUR reflecting its universal adoption. The Decimal Currency Act played a significant role in shaping the modern Irish monetary system. Irish Euro coins come in eight denominations, ranging from the humble 1c to the mighty €2. Each one bears a unique national side featuring the Celtic harp, the year of issue, and the word ‘Éire’ – a proud display of Ireland’s cultural heritage.

Euro banknotes, on the other hand, are uniform across the European Union, with seven denominations from €5 to €500. However, Ireland has had its moment in the spotlight with the issuance of commemorative €2 coins. These special coins have celebrated various milestones, such as the 50th anniversary of the Treaty of Rome and the centennial of the Proclamation of the Irish Republic. This is made possible through the support of a large central bank, ensuring the smooth circulation of these commemorative coins.

Northern Ireland: The Pound Sterling

Northern Ireland’s currency of choice is the British Pound Sterling, reflecting its status as part of the United Kingdom. In the past, the Irish Pound was used in the Republic of Ireland, but it has since been replaced by the Euro. The Pound Sterling circulates as both notes and coins, each with a variety of designs and denominations. The notes range from £5 to £100, while the coins go from the modest one penny to the substantial two pounds.

The coins are a marvel of material diversity, with copper-plated steel, nickel-plated steel, and cupronickel among the components used. The one pound coin is particularly notable for its 12-sided shape and bimetallic composition. Meanwhile, the two pound coin also boasts a bimetallic design and features inscribed edges.

Currency Conversion Tips

Knowing where and when to exchange currency can be a bit of a puzzle, but a little knowledge goes a long way. For starters, converting your money locally before your trip can help you dodge the high rates and commission fees often found at airport currency desks or services near tourist attractions.

Alternatively, using a credit card for purchases or withdrawing cash from ATMs can offer more favorable exchange rates compared to cash exchange services. Just be sure to decline Dynamic Currency Conversion offers and opt to be charged in the local currency for the best deals.

Before You Go

Before boarding your flight, it might be worth visiting your bank or a currency exchange service to acquire some Euros. This can help you avoid unfavorable exchange rates and fees at the airport or popular tourist spots. However, avoid purchasing a large amount of Euros before your trip, as these services may charge a significant markup over the actual exchange rate.

Instead, bring a small amount for immediate expenses upon arrival, and withdraw the rest in Ireland.

ATMs in Ireland

ATMs, affectionately referred to as ‘cashpoints’ in Ireland, are your best friends when it comes to accessing cash. They’re conveniently found even in small towns and villages across Ireland, making it easy for you to withdraw cash as and when you need it. Just keep in mind that ATMs are less common in more remote areas, so plan your cash flow accordingly if you’re venturing off the beaten path.

Prior to heading to the nearest ATM, make sure you’ve checked with your bank regarding possible fees for ATM withdrawals and transaction limits. Using a debit card at Irish bank ATMs can help you avoid additional ATM fees. And remember, most ATMs in Ireland will accept credit cards for cash withdrawal, but always check fees for cash advances and foreign transactions with your credit card company.

Credit and Debit Card Usage

Visa and Mastercard reign supreme in Ireland, with these credit and debit cards visa being widely accepted. On the other hand, cards like Diners Club and other less common ones may not be as universally accepted. While card payments may be convenient, be aware of potential international service charges, which could range from 1-3%. Some businesses might also impose minimum spending limits or service charges for card payments.

Before you embark on your journey, make sure to:

Notify your bank of your travel plans to prevent any potential issues with your card. This will help ensure that your transactions are not mistakenly flagged as fraudulent.

Carry at least two credit cards from different banks, just in case one card gets compromised.

Don’t forget about the ‘chip and PIN’ system used in Ireland – an added layer of security for your transactions.

These steps can help prevent any hiccups with your account while you’re abroad.

Widely Accepted Cards

As mentioned earlier, Visa and Mastercard are your best bets in Ireland. These major credit cards are widely accepted in both the Republic of Ireland and Northern Ireland, making them convenient options for your transactions. But if you’re an American Express or Diners Club cardholder, be prepared for potentially limited acceptance, especially compared to Visa and Mastercard.

Notifying Your Bank

Ensure to notify your bank about your travel itinerary before you arrive in Ireland. This helps ensure uninterrupted access to your funds while you’re there, especially when using Irish banks. Confirm any potential fees for ATM withdrawals and transaction limits so you can effectively manage your cash flow.

Even with a notification, there’s no guarantee that your account won’t be locked due to suspected fraud, but it’s a precaution worth taking.

Cash vs. Cards: Pros and Cons

The debate between cash and cards is much like choosing between a pint of Guinness and a shot of Jameson – it depends on personal preference and circumstance. Both have their pros and cons. Credit cards, for instance, offer security benefits such as being easier to replace if lost or stolen, and the ability to dispute unauthorized charges. On the other hand, carrying large amounts of cash can pose safety risks, and lost or stolen cash is usually unrecoverable.

That said, cash is an immediate form of payment that is accepted universally across Ireland. It’s particularly handy in rural counties and smaller establishments where card payment systems might not be always available. On the flip side, cards enable the ability to monitor and control expenditure, allowing you to track your spending in Ireland more effortlessly. Ultimately, a combination of both cash and cards can provide the most convenience and security.

Benefits of Using Cash

While cash carries the risk of being lost or stolen, it offers several benefits. Cash is universally accepted in Ireland, ensuring that you can make purchases without issues related to card acceptance. This is particularly notable in rural counties and smaller establishments where card payment systems might not be always available.

Plus, using cash supports the local Irish economy more directly by eliminating intermediary fees charged by card networks.

Advantages of Card Payments

Cards offer a level of security and convenience that cash can’t match. They enable you to monitor and control your expenditure, as you can review itemized statements to track your spending in Ireland. Using cards for purchases in Ireland can be quicker and sometimes cheaper than using cheques.

Moreover, payment cards are generally globally recognized, and using cards for foreign transactions in Ireland may provide better exchange rates than other methods.

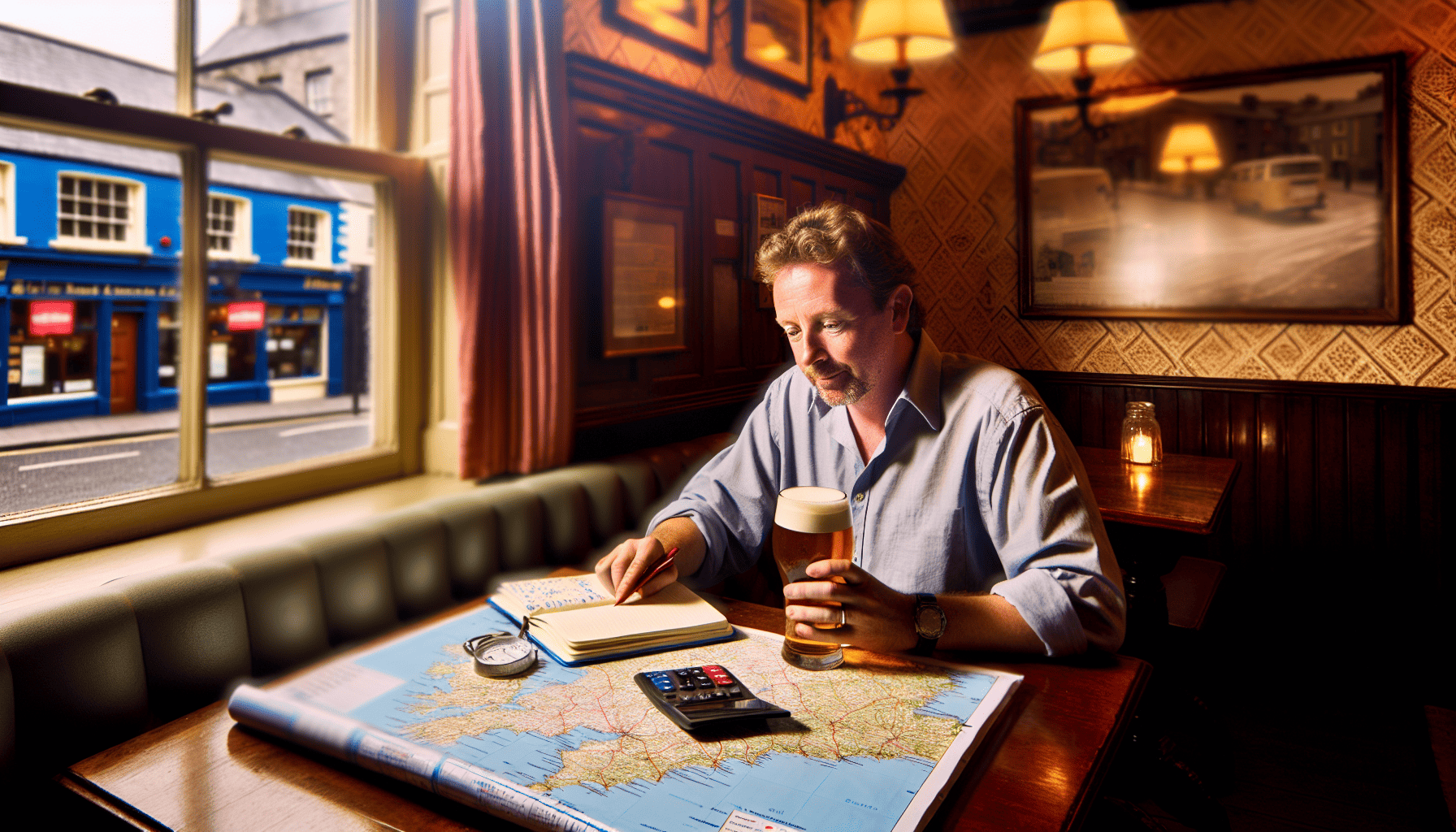

Budgeting for Your Irish Adventure

Setting out on an Irish adventure is thrilling, but it’s crucial to carefully plan your budget. From accommodations and meals to transportation and activities, your daily expenses can add up quickly. But don’t worry, with some careful planning and savvy tips, you can make the most of your budget without compromising on your experience.

Also, bear in mind that VAT refunds cannot be claimed by travelers for service-related expenses such as hotel accommodations, food, and car hire. So, be sure to factor these costs into your budget.

Estimating Daily Costs

In terms of budget planning, take into account the average daily expenses. A good ball-park figure to start with is around $150 (€137) per day. This covers:

Meals

Accommodations

Local transportation

Activities

It’s essential to consider the high season when prices may increase, affecting meal, transportation, accommodation, and activity expenses.

Taking into account all mentioned expenses, a week-long trip for a pair in Ireland approximately amounts to $2,104 (€1,922).

Money-Saving Tips

Budgeting doesn’t mean you have to skimp on your experiences. In fact, there are many ways to save money without sacrificing the quality of your trip. For instance, you could opt for budget accommodations such as:

hostels or budget hotels, which cost around €30-€50 per day

sharing hotel rooms, which can provide additional savings

staying outside city centers for extended periods, which can lead to discounts.

Food costs can also be minimized by utilizing grocery stores, cooking in hostels, and choosing modest dining establishments. Public transit, walking, and cycling offer significant savings over taxis. If you’re planning to rent a car, consider leasing a manual and small car to reduce rental expenses. Also, consider using the OPW Heritage Card and Dublin Pass for attractions, opt for group tours over private ones, and travel during shoulder seasons for better deals.

Tipping Etiquette in Ireland

Tipping etiquette in Ireland may differ somewhat from what you are accustomed to, particularly if you hail from the United States. Unlike the U.S., Ireland does not have a strong tipping culture. Tipping is seen as a voluntary gesture to show appreciation for good service, and there is no obligation to tip.

However, in restaurants, especially in larger cities like Dublin, it’s common for a service charge to be included in the bill. When dining with larger groups, a typical service charge may be around 20% and should be checked before deciding to leave an additional gratuity. But remember, tipping should reflect the quality of service, not just the norm.

Restaurants and Pubs

In restaurants, a 10-15% tip is customary for good service if a service charge is not included on the bill. However, for large groups of 15 to 20 people dining at a restaurant, a 20% tip is usually expected. But remember, a tip is considered acceptable if the service has been notably good.

In pubs, tipping isn’t common for every drink purchased, but small tips may be expected for table service or after a meal with the 10%-20% guideline. In fact, it’s uncommon to leave a tip in pubs, but customers often show appreciation by rounding up the bill or leaving small change.

Taxi Drivers and Tour Guides

Tipping taxi drivers and tour guides in Ireland is also at your discretion. While tipping taxi drivers is not standard practice, if you choose to tip, common methods include rounding up the fare or adding a small amount for friendly and helpful service.

For tour guides, tipping should reflect your satisfaction with the service. A common tip is €2-€5 at the end of each day of a multi-day bus tour or €10 per person for semi-private groups. The amount can vary depending on the tour’s length and the quality of service.

VAT Refunds for Non-EU Visitors

A lucrative opportunity awaits non-EU visitors in the form of VAT refunds on goods bought in Ireland. Thanks to the Retail Export Scheme, you can get tax relief on purchases that you take back home. This can be a significant saving, especially if you’re planning on doing a lot of shopping during your trip.

Bear in mind that this scheme is applicable only to goods, not services. So, any VAT paid on hotel accommodations, meals, and car rentals cannot be reclaimed. However, shopping duty-free for trinkets and Irish whiskey can be a more cost-effective option, especially for travelers leaving the EU.

How VAT Works

In Ireland, VAT, or Value-Added Tax, is normally incorporated into the price displayed for goods and services. This means that the price you see is the price you pay. However, if you’re a non-EU visitor, you can claim a refund of VAT for goods you purchase in Ireland when these goods are taken out of the European Union.

This can result in significant savings, especially on higher-priced items, allowing you to have more spending money.

Claiming Your VAT Refund

The process of claiming your VAT refund is quite simple. Here are the steps:

Ensure your total purchase including tax is over €75.

Export the goods out of the EU within three months from the end of the purchase month.

For high-value goods over €2,000, including VAT, you will need to make a presentation to Customs with the appropriate paperwork.

At the time of purchase, obtain a VAT refund form, and keep all receipts and the form for presentation at the airport. At the airport, make sure to arrive early to process the VAT refund, with goods available for inspection. Customs stamping of the VAT refund form is obligatory as proof of export before leaving the EU.

Summary

Navigating Ireland’s dual currency landscape might seem daunting at first, but with this comprehensive guide, you’re well-equipped to handle the Euro and the Pound Sterling like a local. From understanding the unique features of Irish currency to mastering the art of currency conversion and tipping etiquette, you’re now ready to make the most of your Irish adventure.

Remember, whether you’re sipping a frothy pint in a Dublin pub or exploring the wild beauty of the Cliffs of Moher, having a clear understanding of Ireland’s currency dynamics can help you focus more on the experience and less on the logistics. So, pack your bags and set your sights on the Emerald Isle – a memorable adventure awaits!

Frequently Asked Questions

What is the Irish currency?

The Irish currency is the euro, represented by the € symbol or abbreviated as EUR. Northern Ireland, being part of the UK, uses the pound sterling, represented by the £ symbol or abbreviated as GBP.

Is Ireland in pounds or euros?

Ireland uses the euro in the Republic of Ireland and the pound sterling in Northern Ireland, so you need to be prepared with both currencies if you plan to travel to both parts.

Is Irish pound same as British pound?

No, the Irish pound is not the same as the British pound. The Republic of Ireland used the Irish Pound until it adopted the Euro in 1999 while Northern Ireland uses the British pound as part of the United Kingdom.

Can I claim VAT refunds on my hotel accommodations and meals in Ireland?

Unfortunately, you cannot claim VAT refunds on hotel accommodations and meals in Ireland as they are considered service-related expenses.

How much should I tip in restaurants and pubs in Ireland?

In Ireland, it’s customary to leave a 10-15% tip in restaurants for good service, if a service charge is not included. In pubs, tipping isn’t common for every drink, but a small tip may be expected for table service or after a meal.